Econ. 614 B - Cost Benefit Analysis

Semester Paper: Econ. 614 B: Cost Benefit Analysis

BASIC MEASURES OF PROJECT WORTH OF INVESTMENT

Semester Paper Submitted as Requirement for the Internal Examination of the

M. Phil. in Economics

Submitted to:

Tribhuvan University

Central Department of Economics

M. Phil. Programme

Submitted by:

Yogendra Dahal

Roll No.: 14

1. Introduction

A structured methodology of

forecasting and comparing the anticipated costs and benefits of alternative

courses of action in order to identify the most effective manner of achieving a

stated goal or objective.

CBA is a process used to determine the

value of a project in relative terms. Project justification is measured as

economic worth to the community. To evaluate a project’s benefit to the

community, a CBA will compare the benefit with the overall cost, to deliver and

sustain the project. If overall benefits are demonstrated to exceed the

expected costs, a project is considered economically viable.

It is an ex ante

exercise. As a technique, it is used most often at the start of a programme or

project when different options or courses of action are being appraised and

compared, as an option for choosing the best approach. It can also be used,

however, to evaluate the overall impact of a programme in quantifiable and

monetized terms.

Nearly every business decision requires a

cost-benefit analysis. Such an analysis can point out the risks and rewards of

decisions or actions. Without cost-benefit analysis, there may be the risk of

taking unprofitable tasks and wasting valuable time and money because guessing

at the benefits or going by instinct can be a recipe for business failure.

A cost-benefit

analysis is used to evaluate the risks and rewards of projects under

consideration. It can be used to project the potential benefits of investing in

marketing ideas, product development, infrastructure enhancements and

operational changes.

2. Subject Matter

A project is simply accepted or rejected on the basis

of these measures depending on the nature of project. In a word, Net Present

Value (NPV), Benefit Cost Ratio (BCR) and Internal Rate of Return (IRR) with

the discount rate are the measures to compare projects' cost and benefit for

project worth. Descriptions of these instruments of cost benefit analysis are

as follows:

(a) Discount Rate

The

rate, per year at which future values are diminished to make them comparable to

values in the present is discount rate. In other words, looking present from

future or future to present or backward looking is discount rate. The discount

rate is also called the present worth factor.

Once all the relevant costs and benefits are expressed in monetary terms, it is necessary to convert them into a common metric, their present value. This process is called discounting and it is based on the fact that the individuals have time preferences between consumption in different periods. The rate at which an individual is willing to exchange the present consumption for the future consumption is called the discount rate. The higher is the discount rate, the greater preference is given to the present consumption.

Where,

Dt = discount factor

r = rate of interest

t = number of time period

(b) Net Present Value (NPV)

Net Present Value (NPV) is the difference

between the present value of cash inflows (cost) and the present value of cash

outflows (benefit) occurs in the course of project's lifetime. NPV is used in

capital budgeting to analyze the profitability of a projected

investment or project. It tells the magnitude of the project and takes

into account the time value of money.

The following is the formula for calculating

NPV:

Ct = Cost of year t

Bt = Benefit at year t

t = number of time periods (1, 2, ……, t)

r = interest (discount) rate

The net present value criterion is an absolute figure

to decide whether investment in a particular project or a number of alternative

projects should be made or not. If NPV is higher than zero, then investment in

project is worthwhile. In the case of the selection of a project from a number

of alternative projects, the projects would be arranged in descending order of

NPV. Generally, an investment with a positive NPV will be a profitable

one and one with a negative NPV will result in a net loss. This concept is the

basis for the Net Present Value Rule, which dictates that the only investments

that should be made are those with positive NPV values.

(c) Benefit Cost Ratio (BCR)

NPV gives the absolute value only. It does not tell us the rate of return per rupee of investment. For this we need another instrument i.e. Benefit Cost Ratio (BCR). It is the ratio of present worth of benefit stream to present worth of cost stream. Benefit cost ratios are most often used in corporate finance to detail the relationship between possible benefits and costs, both quantitative and qualitative, of undertaking new projects or replacing old ones. Mathematically,

The investment is said to be profitable when the

BCR is one or greater than one. This method is widely used in economic analysis

and not in private investment analysis. BCR is superior measure in the sense

that it measures return in per unit of cost but in the case of large investment

projects BCR measure may not appropriate because the lower investment project

may have higher BCR.

(d) Internal Rate of Return (IRR)

BCR does not tell us what benefits of project

can generate during its lifetime. For this we need another instrument i.e.

Internal Rate of Return (IRR). The internal rate of return (IRR) represents the

interest rate in which the net present value (NPV) of a project's expected total

cash flows, both positive and negative, sum to zero.

It represents the average earning power of the money used in the project over the project life. It is also sometime called yield of the investment. IRR is the discount rate that sets NPV = 0 and BCR = 1. It is the interest rate that makes the total value of present benefit equal to present value of total cost.

Symbolically,

Rate of interest, which if used as

the discount rate for a project, would yield a NPV of zero. It is the discount

rate at which it would be just worthwhile doing project. So the IRR is the

discount rate, r*, at which:

Where,

r* = Internal rate of return

3. Analysis

On the basis of subject matter of the study, the

instruments of cost benefit analysis further explained with the help of

illustration.

(a) Calculation of

Discount Rate

An individual is not necessarily indifferent between

receiving Rs 100 today and receiving the same Rs. 100 in ten years time. This

is true even if there is no inflation, because Rs 100 today can be used

productively in the consequent ten years, producing a value greater than the

initial Rs 100. The rate at which an individual is willing to exchange the

present consumption for the future consumption is called the discount rate.

The present value of a cost or a benefit X received

in time t given the discount rate r is calculated as follows:

For example, if the discount rate is 10%, a benefit

of Rs 1000 received in 8 years is:

Similarly, if the discount rate is 15%, a benefit of

Rs. 1000 received in 8 years is:

(b)

Calculation of Net Present Value

When discount rate is used in cost benefit analysis, computation of

NPV of investment is possible for different years. For example,

|

Year |

Project

Cost |

Project

benefits |

Net

cash flow |

Discount

factor (10%) |

Present

value of benefit and cost |

Discount

Factor (15%) |

Present

Value of Benefit and cost |

|

1 |

5200 |

1000 |

-4200 |

0.9091 |

-3818.18 |

0.8696 |

-3652.17 |

|

2 |

100 |

1000 |

900 |

0.8264 |

743.8017 |

0.7561 |

680.5293 |

|

3 |

100 |

1000 |

900 |

0.7513 |

676.1833 |

0.6575 |

591.7646 |

|

4 |

100 |

1000 |

900 |

0.6830 |

614.7121 |

0.5718 |

514.5779 |

|

5 |

100 |

1000 |

900 |

0.6209 |

558.8292 |

0.4972 |

447.4591 |

|

6 |

100 |

1000 |

900 |

0.5645 |

508.0265 |

0.4323 |

389.0948 |

|

7 |

100 |

1000 |

900 |

0.5132 |

461.8423 |

0.3759 |

338.3433 |

|

8 |

150 |

1000 |

850 |

0.4665 |

396.5313 |

0.3269 |

277.8665 |

|

|

|

|

2050 |

|

141.745 |

|

-412.538 |

The net present value (NPV) is the sum of the

discounted annual cash flows (Present value of benefit), taking an interest of

10% and 15%

NPV = Present worth of Benefit stream – Present worth

of Cost Stream

The net present value represents the net benefit over

and above the compensation for time and risk. NPV is higher than zero (141.745)

at 10% discount rate, the investment in the project is worthwhile. Project,

which have negative NPV (-412.538) at 15% discount rate is rejected.

c) Calculation of

Benefit Cost Ratio

For return per unit of investment, we use benefit

cost ration (BCR). Calculation of benefit cost ration is the same as that of NPV.

But, we have to divide the present value of benefit by present value of cost.

For correct result, NPV is not enough, we have to calculate BCR

It means for every rupees investment, projects will get

Rs. 1.037 return from 10 percent discount rate and Rs. 0.887 from 15% discount

rate.

(d) Calculation of

Internal Rate of Return

The process of determining IRR is trial and error. If

the result is positive a higher rate is used, if negative a lower rate is used

and process is repeated until NPV is reduced to zero. Thus, the discount rate

that yields a zero NPV and BCR equal to one is the IRR. If the discount rate

used in NPV is less than the social discount rate i.e. the value of IRR, the

project under consideration is worthwhile. IRR tells maximum returns that a

project generates maximum during its life time. We need at least two discount

rate to calculate IRR. Suppose 10% and 15% are two discount rates.

It is computed through the following method

If we plot this discount rate (IRR=11.1251)

on the below formula we will get NPV exactly equal to zero, it means BCR equals

to one.

IRR is always compare with a market rate of interest

for validate to use. In this case, IRR is 11.1251% and if market rate of

Interest is 12%, than project rejected. So, if IRR > rate of interest than

project is accepted otherwise rejected.

(e) Relationship

between NPV and IRR

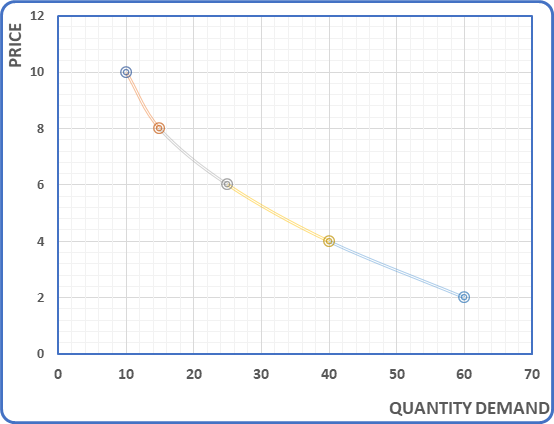

To see the link between them, we put the values of

NPV for different discount rates on the vertical axis and the discount rate on

the horizontal axis.

The above figure shows when the interest increases from 10% to 15% NPV declines from 141.745 to -412.538 and When IRR equal to 11.1251 then NPV becomes zero.The IRR is the point at which the NPV profile crosses the x-axis. The slope of the NPV profile reflects how sensitive the project is to the changes in discount rate.

4. Findings

·

Looking present from future or future to

present or backward looking is discount rate. The discount rate is also called

the present worth factor where all the relevant costs and benefits are

expressed in monetary terms to convert them into a common metric.

·

NPV

is used in capital budgeting to analyze the profitability of a

projected investment or project. It tells the magnitude of the

project and takes into account the time value of money.The above results shows

that, the project with 10% discount rate is accepted because NPV (141.745) is

positive and profitable but we can't accept the project of 15% discount rate

due to the negativity of the NPV(-412.538).

·

BCR

is superior measure in the sense that it measures return in per unit of cost

but in the case of large investment projects BCR measure may not appropriate

because the lower investment project may have higher BCR. BCR is greater than

one (1.037) at 10% discount rate; the discounted benefits outweigh the

discounted costs, means the project results in net gains for the society. But due

to BCR less than one (0.887) from 15% discount rate is not acceptable.

·

IRR represents the average earning power

of the money used in the project over the project life. It is also sometime

called yield of the investment. IRR is the discount rate that sets NPV = 0 and

BCR = 1. From the computation of the above given cost and benefit stream with

10% and 15% discount rate we get IRR equal to 11.1251. If we plot

this discount rate (IRR=11.1251) on the below formula we will get BCR exactly

equal to zero, it means BCR equals to one. IRR is always compare with a market rate of interest

for validate to use. In this case, IRR is 11.1251% and if market rate of

Interest is 12%, than project rejected. So, if IRR > rate of Interest than

project is accepted otherwise rejected.

5. Conclusion

NPV is a measure of the absolute welfare

gain over the whole life of the project. The key determinants of the

NPV calculation are the appraisal horizon, the discount rate and the accuracy

of estimates for costs and benefits.

Relative measure of benefit which

indicates the capacity of the project to generate the benefit is BCR. The

choice of an appropriate discount rate is a main limitation of BCR. Once an

appropriate discount rate is provided, the BCR is a better guide for investment

decision compared to the NPV criterion.

IRR approach

is mostly used by financial managers as it is expressed in percentage form and

excellent guidance on a project’s value and associated risk with an advantage of knowing the actual

returns of the money which you invested today. If discount rate for the project

changes every year then, it is difficult to make such comparison.

Economies of scale, reinvestment rate, dependent or contingent project, mutually exclusive projects, different duration of the project, a mix of positive and negative future cash flows etc. are the basic limitations of the NPV, BCR and IRR calculation method. From the careful observation over these limitations provide guidelines for the valuation of costs and benefits by using different several criteria for project evaluation.

References

Asian

Development Bank. A Practical Guide : Cost Benefit Analysis for Development.

Chandra,

P. (2006). Projects: Planning, Analysis Selection, Financing, Implementation

and Review (6th ed.). New Delhi: Tata McGrawhill.

Dasgupta,

A.K and D.W Pearce (1978). Cost Benefit Analysis:Theory and Practice.

London

Hurley,

R. (2014). Cost-Benefit Analysis. ASMC National PDI Settle.

Irvin,

George (1978). Modern Cost Benefit Analysis. Barnes and Noble.

Layard,

R and S. Glaister (eds). Cost Benefit Analysis. Cambridge University

Press.

Mishan,

E.J. (1975). Cost Benefit Analysis. Great Britain: Page Bros Ltd.

Pitale,

R.L (1982). Project Appraisal Technique. New Delhi: Oxford and IBH

Publishing Co. Pvt. Ltd

Ray,

A. (1984). Cost Benefit Analysis Issues and Methodologies. The World

Bank.

Sharma, Sarad K. "Class Notes on Semester Paper

Outline." Presentation at the M. Phil. Class, T.U., Kirtipur, December

09, 2016.

Sharma,

S. (1998). "Public Investment: Some Measuring Instruments".

Tribhuvan University Journal. Vol XXI-2. pg 35-46. Central Department of

Economics, TU, Kirtipur

Comments

Post a Comment

If you have any doubt, Please let me know !