Unit 2.1 - Market and Revenue Curves

Concept of Market & Market Structure

'Market' refers to the existence of direct or indirect

contact between the seller and buyers for buying and selling of a commodity at

a given price.

'Market Structure' refers to the selling environment in which a firm produces & sells its products. It is basically defined by following features: number of buyer and seller of the product, type of the product bought (product differential) & sold, degree of mobility of resources, market information, market entry conditions and the extent to which the actions of firm will affect another firm.

Meaning

and Characteristics of Perfect Competition Market

Meaning/Introduction

of PCM

This market is characterized by complete absence of

rivalry among the individual firms & there is a perfect degree of

competition & single price prevails. Hypothetical market structure &

firms are incapable of influencing the market price either by acting singly or

in a group. e. g. digital marketplace, such as ebays, alibaba.com, amazon.com

etc.

Perfect competition refers to the market structure in

which there are many utility-maximizing buyers & profit-maximizing sellers

of a homogeneous good or service in which there is perfect mobility of factors

of production & both buyers, sellers have perfect information about market

conditions and entry into & exit from the industry is very easy.

Features (Conditions)

- Many buyers & sellers exist that no one

can influence the price, which is determined by collective effort of all the

buyers & sellers.

- Homogeneous or perfectly standardized

commodity

& perfect substitute from the buyer's point of view. So, the sellers do not

spend on advertisement & publicity.

- Free entry & exit (no barriers): profit → new firm

attract & loss → firm leave the industry

- Existing buyer – purchase ↑ or ↓, new can also enter & offer to buy

- Perfect mobility of factors of production: Free to move from

one firm to another throughout the economy for high wage

- Complete market information: to the buyers

& sellers regarding condition of market i.e. price of the product, nature

of product, product cost, wage rate. Advertisement & selling methods do not

have an effect on consumer behavior.

- Sole objective of profit maximization

- Economic rationality: Every buyer &

seller is motivated by his own economic interest in his decision to buy &

sell

- No transportation cost: single uniform

price of the product (firms are supposed to equally far from the market)

- No government regulation: in the form of

tariffs subsidies

- Firms are price takers

- Horizontal sloping demand curve

- Independence of decision making: none of them are

committed to anyone. (buyers – free to purchase, sellers – free to sell)

- Firm & industry concept

Meaning

and Characteristics of Perfect Competition Market

Meaning /

Introduction of Monopoly

The term 'monopoly' is derived from Greek words 'mono'

which means 'single' and 'poly' which means 'seller'. So, monopoly is an

extreme imperfect market structure, where there is only a single seller

(individual, partnership or joint stock) producing a product or serves the

market having no close substitutes. Such a single seller or firm in market is

called monopolist.

In this market, there is barrier to entry and firm is

price maker. It means monopolist has full control over supply and monopolist

does not have interdependence with other competitors. So, he can generate high

profit either by increase in price or high number of sales.

Sources of Monopoly

- Legal Restrictions: For e.g. Cafeteria

in a hospital compound, licensing to a single cable television supplier.

- Patents: Patent right

privilege granted to an inventor and for a specified period of time prohibits

anyone else from producing or using that invention without the permission of

the holder of the patent. For e.g. pharmaceutical companies for medicine they

discover.

- Control of a Scarce Resources or Input: For e.g. South

African DeBeers Diamond Organization.

- Deliberately Created Entry Barriers: Costly court cases

against new rivals on false and deliberately invented charges, excessive

amounts on advertising.

- Market Franchise: License or

permission by a government in a particular area.

- Large Sunk Costs: Huge investment

and long payback period. For e.g. Boeing corporation of US and Airbus of Europe

- Technical Superiority: Technological

expertise or technological brainpower of IBM corporation of US creates monopoly

for many years and nowadays MS corporation for operating system (MS-DOS and

Windows), office packages (MS Office) and other utility software.

- Economies of Scale: Very low AC of

production

- Tariff Barrier: Heavy duty on

imported goods to protect domestic firm or market from foreign competition may

create monopoly.

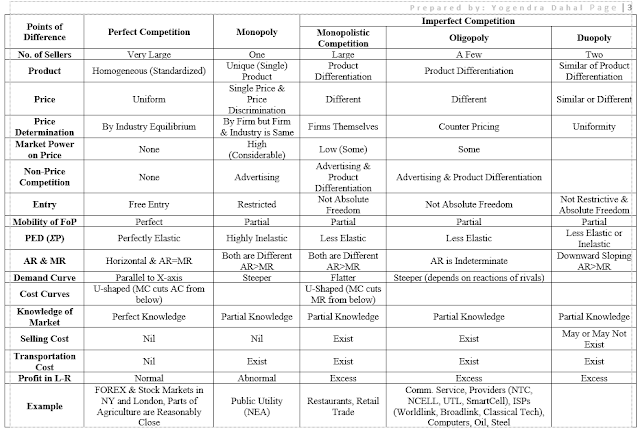

Difference between Various Markets

Features of Monopoly

- Sole Supplier of the product

serves the large number of buyers and monopolist is regarded as 'a king without

crown'.

- No Close Substitutes: No other firm

produces the same commodity i.e. 𝛴XY = 0. For e.g.

NOC, NEA in case of Nepal.

- Barriers to Entry: Legal (patent, copy

right) or natural restriction, artificial, economic or institutional barriers

(control over essential inputs, economies of scale)

- No Distinction between Firm &

Industry: Firm

is itself an industry

- Independent Price Policy: Price maker

- Possibility of Price Discrimination

- Profit Maximization Objective: Either by

increasing price or sale [TR↑ = P↑×Q↓ or TR↑ = Q↑×P↓]

- Negative Sloped Demand Curve

- Imperfect Dissemination of Information: Imperfect

knowledge about market

- Control Over Supply

- Monopoly Cases are Found in LDCS not in DCS

Concept of Revenue

For a firm or company revenue is the total amount of

money received or acquired by company or firm from goods sold and service

provided once it has paid indirect tax, such as VAT during a certain time

period. It also includes all net sales, exchange of assets; interest and any

other increase in owner's equity and is calculated before any expenses are

subtracted.

In the case of government, revenue is the money

received from taxation, fees, fines, inter-governmental grants or transfers,

securities sales, mineral rights and resource rights, as well as any sales that

are made.

Revenue provides the income which a firm needs to enable it to cover

its costs of production (expenses), and from which it can derive a profit (B = TR – TC). So, revenue (top line or gross income) of a firm is

important for the determination of profit (net income) and that profit can be

distributed to the owners, or shareholders, or retained in the business to

purchase new capital assets or upgrade the firm’s technology.

Concepts of Total, Average and Marginal

Revenues

Total Revenue (TR)

TR is the total earning of a firm by selling certain (given) amounts of its products at a price. If a firm sells 100 units of output at a price of Rs. 10, total revenue will be Rs. 1000 (Rs.10×100). It is obtained by multiplying per-unit price of the commodity by the quantities of the commodity sold.

It is expressed as: TR =

P×Q

Where P = price per unit and Q = quantity sold.

Similarly, TR = MR1 + MR2 + ……+ MRn

The revenue is important to the analysis a firm's

short-run production decision to maximize profit.

Average Revenue (AR)

AR is the revenue per unit of output sold. It is also called average receipt from the sale of certain quantities of a commodity. It is obtained by dividing the total revenue by the quantities sold. If Rs. 1000 is received from the sale of 100 units of a commodity, then AR is equal to Rs. 10. It is expressed as:

AR = TR/Q = (P×Q)/Q = P

AR in fact is the price of the commodity at each level

of output. Therefore, it can be written that AR = P. If the price is constant,

then AR is also constant; but if price changes with respect to quantity, then

AR is also variable.

The AR curve of a firm is the demand curve of a

consumer because price paid by a consumer is the revenue received by a firm

which shows the different quantity transected at different prices.

Marginal Revenue (MR)

MR is the addition to the total revenue as a result of

one unit increase in the sale. In other words, it is an increase in total

revenue resulting from an increase in the level of output by one unit. It is

expressed as:

MR = ΔTR/

or, MRn = TRn – TRn-1

(MR is derived by subtracting the TR from first unit of output from the second

unit of output)

For example, if TR from 10 units of output sold is Rs. 200 and from 11 units sold is Rs. 220, the MR will be Rs. (=220-200).

Derivation

of TR, AR & MR Curve Under PCM & Monopoly

Derivation of TR, AR & MR Curve Under

PCM

PCM is a market structure with a large number of small

firms, each selling identical goods. Perfectly competitive firms have perfect

knowledge and perfect mobility into and out (free entry into and free exit) of

the market. These conditions mean perfectly competitive firms are price taker,

they have no market control and receive the going market price for all output

sold. Different units of the commodities are sold at the same price. When

different units are sold at the same price AR will be equal to MR.

Under PCM price is determined by market forces viz.

demand and supply. The price is beyond the control of a firm. The AR or price

thus remains constant. As a result, the demand curve of a firm becomes

perfectly elastic to output and perfectly inelastic to the price.

If different units are sold at same price, MR equals

to AR (price). With the additional sale, TR increases at the rate of price.

Illustration

|

Units

of Sale |

P

or AR |

Total

Revenue (P×Q) |

MR |

|

0 |

10 |

0 |

- |

|

1 |

10 |

10 |

10 |

|

2 |

10 |

20 |

10 |

|

3 |

10 |

30 |

10 |

|

4 |

10 |

40 |

10 |

|

5 |

10 |

50 |

10 |

As shown in the table, the price is constant at Rs. 10 for all units. Hence, the AR is also constant at Rs. 10. The TR is increasing at constant rate with increase in units of sale. It goes on increasing by Rs. 10 with every increase in units of sale. MR is the change in TR. Therefore, MR is constant at Rs. 10.

Hence, AR and MR are equal and constant at every unit.

The TR, AR and MR curve can be derived from above illustration.

In figure, TR is the TR curves. It slopes upward at a constant rate with the increase in quantity of sales. So, TR curve slopes upward in a uniform manner. AR and MR are AR & MR curve respectively. The MR curve coincided with AR curve because they are equal. AR and MR curve is parallel to x-axis which shows that price is constant even if the quantity sold increases.

Derivation of TR, AR & MR Curve Under Monopoly

A market in which one or more basic features of the

market of perfect competition are not found is known as an imperfect

competition (e.g. monopoly, monopolistic competition, and oligopoly). Under

imperfect competition, a firm can increase sale by reducing the price of the

commodity. It implies that the firm faces a downward sloping AR or demand

curve. When AR curve slopes downwards, MR curve will also slope downward and it

lies below the AR curve.

In monopoly, there is a single seller, as a single

seller, it has control over price or supply of the product like other producer,

profit maximization is the main objective of monopoly firm. It can maximize

profit, by maximizing sale of by fixing higher price. But generally, monopoly

list lowers his price to maximize sale and profit, AR decreases along with

decrease in price (because in general AR = P). When additional units are sold

at lower price, MR declines. But MR decreases faster than AR. TR of the

monopolist increases at first, reaches its maximum point. After that, if price

is decreased more to sale additional units, TR falls.

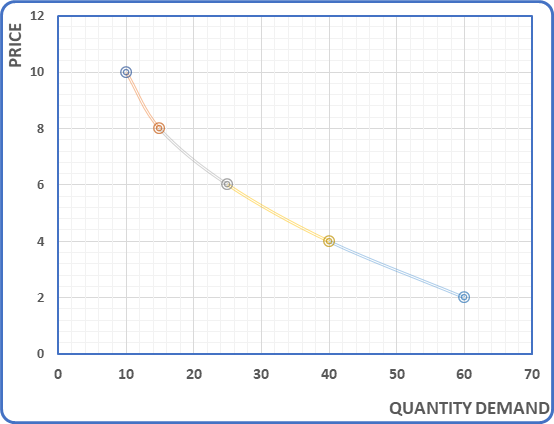

The relationship between TR, AR and MR under monopoly

can be illustrated by the help of following table:

|

Units

of Sale |

P

or AR |

TR

(P×Q) |

MR |

|

0 |

11 |

0 |

- |

|

1 |

10 |

10 |

10 |

|

2 |

9 |

18 |

8 |

|

3 |

8 |

24 |

6 |

|

4 |

7 |

28 |

4 |

|

5 |

6 |

30 |

2 |

|

6 |

5 |

30 |

0 |

|

7 |

4 |

28 |

-2 |

The table shows that a monopolist prefers to lower the

price of his commodity to sell larger quantity. When a monopolist does so, AR

(P) starts to fall. TR increases but at decreasing rate along with additional

unit of sale. Therefore, MR is declining. But the rate of fall in MR is higher

than the rate of fall in AR. At 6th unit, TR is maximum where MR is

zero. After this unit, if price is reduced to sell more units, TR starts to

decline. Therefore, MR becomes negative but AR remains positive. The relation

between AR, TR and MR is represented in the figure below.

In figure, TR is rising along with additional unit of

sale. It becomes maximum at point 6 unit of sale, where MR is zero. MR and AR

both are downward sloping. But MR curve is declining faster than AR curve.

Therefore, MR curve lies between AR curve. MR becomes zero when it touches

X-axis at 6 unit of sale. Beyond this point MR curve below X-axis below

negative but AR remains positive.

Relationship between TR and MR

- As long MR is positive, TR curve is increasing.

- Whenever TR is maximum, MR is zero.

- When TR curve starts to fall (MR) curve falls below X-axis i.e., MR becomes negative.

Comments

Post a Comment

If you have any doubt, Please let me know !