Sources of Government Revenue in Nepal

Sources of Government Revenue in Nepal

In Nepal, the sources of government revenue are diversified, encompassing both tax and non-tax sources. Understanding these sources provides insights into the country's fiscal structure and the government's ability to fund its operations and initiatives.

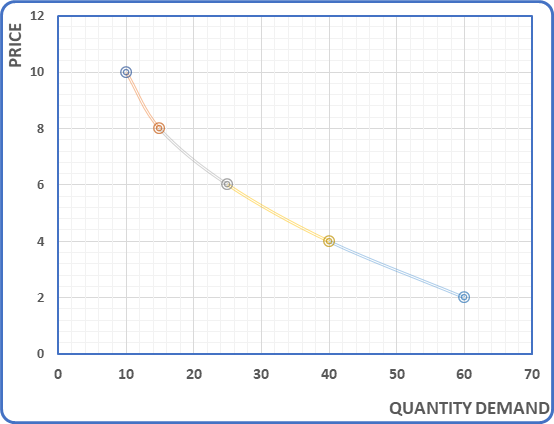

Tax revenue and total revenue exhibited similar patterns (due to dependency), with fluctuations and a net increase over the period. Non-tax revenue also showed growth, albeit with fluctuations. Foreign grants and repayment of internal loan investment displayed more volatile trends, while cash reserves and irregularities recovery remained relatively stable.

The above table illustrates the government's reliance on tax revenue, particularly indirect taxes, as the primary funding source. Non-tax revenue, foreign grants, and other sources also contribute to government income, albeit to a lesser extent. Diversifying revenue sources helps ensure financial stability and supports various government initiatives and expenditures.

The above data demonstrates the distribution of federal revenue across different sources, highlighting the importance of income tax, VAT, customs duties, and excise duties as major contributors. It also underscores the significance of non-tax revenue and miscellaneous sources in diversifying the government's revenue streams.

The above data information highlights the dynamic nature of tax revenue, with import-based and internal tax revenues playing complementary roles in the government's fiscal structure. Understanding these trends can help policymakers make informed decisions regarding taxation policies and revenue management.

Comments

Post a Comment

If you have any doubt, Please let me know !