Ricardian Comparative Cost Advantage Theory of International Trade

Ricardian Comparative Cost Advantage Theory of International Trade

The Theory of Comparative Cost Advantage, also known as the Theory of

Comparative Advantage in international trade, was developed by David Ricardo in

his seminal work "Principles of Political Economy and Taxation"

published in 1817.

This theory states that countries should specialize in producing goods

and services with a comparative advantage – that is, they can make at a

lower opportunity cost than other countries. The opportunity cost refers

to the potential benefit sacrificed when one alternative is chosen over

another.

Ricardo's Theory of Comparative

Cost Advantage focuses on specialization and trade, where countries specialize

in producing goods and services with a comparative advantage, and trade with

others for goods with a relative disadvantage. This leads to efficient global

resource allocation. The theory also emphasizes opportunity cost, where

countries produce and export goods with lower opportunity costs than their

competitors. Comparative advantage allows for mutually beneficial trade, even

if one country is more efficient in producing all goods. The theory also

emphasizes relative productivity differences, where countries can still benefit

from specializing in goods with comparative advantages.

Assumptions

1.

Barter System: Trade between two

countries and two products takes place based on the barter system. Money does

not exist and prices are determined by labor cost.

2.

Free Trade: There is free trade between

two countries without any restrictions and trade barriers i.e. tariff or

non-tariff barriers by the government.

3.

Homogeneous Labor: Labor is the only

factor of production and its productivity remains the same and the cost of

production is measured in terms of labor units.

4.

Mobility of Labor: According to this

theory, Labor is perfectly mobile within a country but perfectly immobile

between the countries

5.

Constant Return: Production is

subject to the constant returns to scale i.e. increase in input is just equal

to an increase in output.

6.

Full Employment: There is full

employment of all factors in both countries.

7.

Cost of Production: Only labor hours

used in producing goods are considered as the production cost.

8.

No Transportation Cost: There is no

transport and transfer cost

9.

No Change in Technology: There is no

technological innovation and no technological spillover.

10.

Perfect Competition Market: The

underlying market structure driving production is based on perfect and free

competition.

David Ricardo famously showed how England and Portugal both benefit by

specializing and trading according to their comparative advantages. In this

case, Portugal was able to make wine at a low cost, while England was able to

cheaply manufacture cloth. Ricardo predicted that each country would eventually

recognize these facts and stop attempting to make a product that was more

costly to generate.

Indeed, as time went on, England stopped producing wine, and Portugal

stopped manufacturing cloth. Both countries saw that it was to their advantage

to stop their efforts at producing these items at home and, instead, trade with

each other to acquire them.

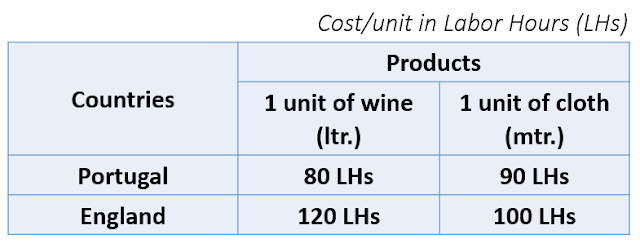

The data shows the labor hours required for producing wine and cloth in Portugal and England. Portugal has a comparative advantage in wine production due to its lower labor hours (80 LHs) compared to England (120 LHs). In cloth production, Portugal has a disadvantage due to its higher labor hours (80 LHs vs. 90 LHs). England has a comparative advantage in cloth production due to its lower labor hours (100 LHs vs. 120 LHs). Therefore, Portugal should specialize in wine production, while England should specialize in cloth production. This allows for trade between the two countries, maximizing their overall production and consumption possibilities.

The above table shows that Portugal has a lower opportunity cost for producing wine compared to cloth (1 unit of wine = 0.89 units of cloth). Thus, Portugal has a comparative advantage in producing wine. On the other hand, England has a higher opportunity cost for producing wine compared to cloth (1 unit of wine = 1.2 units of cloth). Thus, England has a comparative advantage in producing cloth.

The benefit level for both countries and in total can be calculated with the help of below table information as follows:

Without trade, if Portugal

produces 1 unit of wine (W) and 1 unit of cloth (C), requiring a total cost of

170 labor hours. Similarly, England produces 1 unit of wine and 1 unit of cloth,

requiring a total cost of 220 labor hours. In total, both countries produce 2

units of wine and 2 units of cloth, with a total cost of 390 labor hours. Each

country produces both goods domestically, resulting in higher total costs

compared to trade scenarios.

But with Trade &

Specialization, Portugal specializes in producing wine, producing 2 units of

wine with a total cost of 160 labor hours. Similarly, England specializes in

producing cloth, producing 2 units of cloth with a total cost of 200 labor

hours. In total, both countries produce 2 units of wine and 2 units of cloth,

with a reduced total cost of 360 labor hours compared to the scenario without

trade. Therefore, the cost advantage of free trade with specialization for

Portugal is 10 labor hours, and for England, it is 20 labor hours and for both

countries, it is 30 labor hours. So, if there is specialization in producing

the good it has a comparative advantage, leading to lower total costs and

increased efficiency.

On the other hand, if there is

trade but without Specialization, Portugal and England do not specialize and

produce according to their initial comparative advantage. Portugal produces 2

units of cloth with a total cost of 180 labor hours. England produces 2 units

of wine with a total cost of 240 labor hours. In total, both countries produce

2 units of wine and 2 units of cloth, with a total cost of 420 labor hours,

which is higher than the scenario with trade and specialization. Both countries

trade but do not specialize, resulting in higher total costs compared to the

scenario with specialization. This is because they are not fully utilizing

their comparative advantages.

Overall, the table demonstrates

the benefits of trade and specialization in increasing efficiency and reducing

total production costs for both countries.

Comparative Advantage and its

Benefits in Free Trade

First, let’s assume that the

maximum amount of labor hours is 3600 hours available for both countries. In

Portugal, if all labor hours went into wine, 45 units of wine could be produced

and if all labor hours went into cloth, 40 units of cloth could be produced.

Similarly, in England, if all labor hours went into wine, 30 units of wine

could be produced and if all labor hours went into cloth, 36 units of cloth could

be produced.

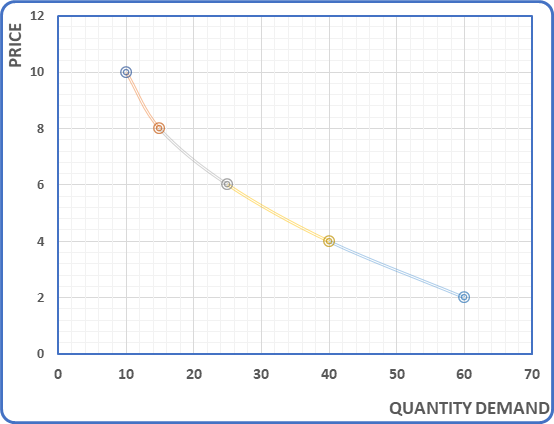

Following Ricardo’s theory of comparative advantage in free trade, if each country specializes in what they enjoy a comparative advantage in and imports the other good, they will be better off. Recall that: Portugal enjoys a comparative advantage in wine and England enjoys a comparative advantage in cloth. This can be explained with the help of the following table and diagram.

The provided table and diagram

illustrate the output, cost, and total cost for Portugal and England under

different trade scenarios: without trade and with trade & specialization.

Without Trade, Portugal produces

22.5 units of wine (W) and 20 units of cloth (C), requiring a total cost of

3600 labor hours. England produces 15 units of wine and 18 units of cloth, also

requiring a total cost of 3600 labor hours. In total, both countries produce

37.5 units of wine and 38 units of cloth, with a combined total cost of 7200

labor hours.

With Trade & Specialization,

Portugal specializes in producing wine, producing 45 units of wine with a total

cost of 3600 labor hours. England specializes in producing cloth, producing 40

units of cloth with a total cost of 3600 labor hours. In total, both countries

produce 45 units of wine and 40 units of cloth, with a total cost of 7200 labor

hours.

Thus, if each country produces

both goods domestically, resulting in lower output compared to trade scenarios.

If they make the trade with Specialization, then each country specializes in

producing the good in which it has a comparative advantage, leading to higher

output and increased efficiency. For this, Portugal specializes in producing

wine, while England specializes in producing cloth, resulting in a more

efficient allocation of resources.

Limitations or Criticism

of Comparative Advantage Theory

1.

Barter

System: The theory operates

under the assumption of a barter system, where trade occurs directly between

goods without the use of money. However, in reality, modern economies operate

with the use of currency, and the absence of money in the model oversimplifies

the complexities of real-world trade.

2.

Free

Trade: The theory assumes

free trade without any restrictions or trade barriers between countries. In

practice, many countries impose tariffs, quotas, and other trade barriers,

which can distort comparative advantage and hinder the benefits of trade.

3.

Homogeneous

Labor and Constant Returns to Scale: The theory assumes homogeneous labor and constant returns to scale,

which may not accurately reflect the diverse and dynamic nature of labor and

production processes in the real world.

4.

Immobility

of Labor: The theory assumes

perfect immobility of labor between countries, which is not realistic as labor

migration is a common phenomenon influenced by various factors such as economic

conditions, policies, and social factors.

5.

Full

Employment: The assumption

of full employment of all factors of production in both countries may not hold

in reality, as economies often experience unemployment and underutilization of

resources.

6.

No

Transportation Cost Assumption: The absence of transportation costs in the model overlooks the

significant role of transportation and logistics in international trade, which

can affect the competitiveness of goods in global markets.

7.

No

Technological Change: The

theory does not account for technological innovation and advancements, which

play a crucial role in shaping comparative advantage and influencing production

efficiencies over time.

8.

Perfect

Competition Market Assumption: The theory assumes perfect and free competition in markets, but in

reality, markets are often imperfect, with monopolies, oligopolies, and other

market structures that can distort trade patterns.

9.

Neglect

of Trade in Services and Technologies: The theory focuses primarily on trade in goods and overlooks the

growing importance of trade in services, ideas, and technologies in the modern

global economy.

10.

Rent-Seeking

Behavior: The theory fails

to address rent-seeking behavior, where certain groups lobby for protectionist

measures to preserve their interests at the expense of overall welfare and

efficiency. This can lead to distortions in trade patterns and undermine the

benefits of comparative advantage.

11.

Negative

Externalities and Exploitation: Overemphasis on comparative advantage can lead to negative

externalities such as environmental degradation and exploitation of labor in

less developed countries, as industries may prioritize profits over social and

environmental concerns.

12.

Dependency

on Global Markets: Over-specialization

in a particular export, such as cash crops in agriculture, can lead to

dependency on global markets. Countries that focus solely on cash crops may

become overly reliant on international demand and prices, leaving them

vulnerable to fluctuations in global commodity markets. This dependence exposes

them to risks such as price volatility, shifts in consumer preferences, and

changes in market conditions.

In summary, while the theory of

comparative advantage provides valuable insights into the benefits of

international trade, it is not without its limitations and criticisms. These

criticisms highlight the need for a more nuanced understanding of trade

dynamics and the consideration of broader economic, social, and environmental

factors in trade policy and practice.

Comments

Post a Comment

If you have any doubt, Please let me know !