Unit 2.2 - Cost Curves

Concept and Types of Cost

Concept of Cost of Production

Cost is related to the financial aspect of production that paid to the services of resources of production (inputs) on the basis of their marginal productivity. Cost of production refers to all the expenditure of a firm on the factor's inputs (Ld, Lb, C, org.) as well as non-factor inputs (raw material, fuel, electricity, depreciation, advertisement, insurance, tax, travelling & transportation) for the production of a commodity in terms of wages, salary, interest, profit, rent, prices for non-factor inputs.

The cost of production varies with the amount of output produced where the output amount depends upon the amount and prices of factor and non-factor inputs.

Cost Function

An understanding of the relation between cost and output is essential for the manager (business decision maker) of a firm to estimate cost of output planned to produce, amount of different factors to be hired, set prices of output to be sold in the market, to utilize least cost combination of inputs corresponding to different levels of output etc.

Cost functions can be measured in both the short-run and long-run by using either data for firms in an industry at a given time (cross section data) or data for an industry over time (time series data). When we combine the production function with the input prices, it determines that cost function of a business unit that produces goods and services. It is a relation between cost of production and various determinants of cost. Symbolically,

C = f (Q, S, T, P)

Where, C = cost, Q = output, S = size of the firm, T = technology, P = factor and non-facto prices

Generally, C = f (Q).

Types of Cost

1.Explicit Cost and Implicit Cost

Explicit Cost: The monetary payments of market-supplied resources to

resource owner or cost of inputs used in production which are not owned by the

firm. This cost is known as visible cost or business or accounting cost or

out-of-pocket cost.

Implicit Cost: The return foregone by not taking the owner's

resources to market or cost of owner supplied resources and time is known as

implicit or imputed cost. For e.g., working in the business while not getting a

formal salary or using the ground floor of a home as a retail store.

2. Fixed Cost and Variable Cost

Fixed Cost: Fixed cost is defined as the expenses incurred on fixed factors of production which cannot be changed in the short-run. Benham states, "The fixed costs of a firm are these costs that do not vary with the size of its output". Even if there is no output at a time, fixed cost will have to be incurred. Thus, fixed cost is independent of volume and scale of production. Fixed cost includes the rent of land, interest on capital, salaries of permanent employees, insurance premium, depreciation of machine & furniture, etc. Fixed cost is also known as overhead cost or supplementary cost or indirect cost.

Variable Cost: Variable cost is defined as the expenses incurred on variable factors of production that can change according to the volume of production. Benham states, "The variable costs of a firm are these costs that do vary with the size of its output". If the quantity of production increases, the variable cost will increase and if the quantity of production decreases, the cost will decrease. Sometime if at a time, the quantity of production is zero, the cost will also be zero. Variable costs also known as prime cost or direct cost includes the cost of raw materials, wages of workers, cost of fuel, etc. Whose amount can be altered in short run. In the short period, a firm must cover up the variable cost otherwise the production of output ceases to stop.

3. Short Run Cost and Long Run Cost

Short Run Cost: Short run is a period of time for day-to-day production decision in which the firm can vary its output by varying only the number of variable factors (labour, raw materials, building, fuel etc.) where fixed factors (capital, equipment, top management etc.) cannot be changed to change the level of output. If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals.

Symbolically, TC = f (Q,T, Pf, Ē)

Where, Pf = prices of factors, Ē=constant factor(s)

Long Run Cost: Long-run is a sufficient planning & implementation period of time during which the firm can vary its output by varying quantities of all inputs (complete flexibility in input use) in response to expected economic profits or losses. Thus, in long-run, output can be increased by increasing capital equipment or by increasing the size of existing plant or by building a new plant.

Symbolically, TC = f (Q, T, Pf, K)

Derivation of Short-Run Cost Curves

A. Short-Run Total Cost Curves

1. Total Fixed Cost (TFC):

Q | TFC |

0 | 30 |

1 | 30 |

2 | 30 |

3 | 30 |

4 | 30 |

5 | 30 |

These total Costs are that cost which does not vary with the level of output. TFC is parallel to X-axis due to constancy in TFC and operation of law of variable.

TFC = AFC×Q = r.K

2. Total Variable Cost (TVC):

Q | TVC | Rate |

0 | 0 | Increases at decreasing rate |

1 | 20 | |

2 | 30 | |

3 | 45 | Increases at increases rate |

4 | 80 | |

5 | 145 |

These total Costs are those costs which vary with the level of output. TVC is opposite S-shaped.

TVC = AVC×Q = w.L

3. Total Cost (TC):

Q | TFC | TFC | TC | |

0 | 30 | 0 | 30 | Increases at decreasing rate |

1 | 30 | 20 | 50 | |

2 | 30 | 30 | 60 | |

3 | 30 | 45 | 75 | Increases at increasing rate |

4 | 30 | 80 | 110 | |

5 | 30 | 145 | 175 | |

TC = TFC + TVC = r.K + w.L

B. Short-Run Average Cost Curves

1. Average Fixed Cost (AFC):

Q | TFC | AFC |

0 | 30 | - |

1 | 30 | 30 |

2 | 30 | 15 |

3 | 30 | 10 |

4 | 30 | 7.5 |

5 | 30 | 6 |

AFC is defined as the TFC divided by the total quantity of output (Q) produced. i.e. AFC = TFC/Q

An AFC decrease continuously with increase in output due constancy in TFC. AFC curve slopes downward and it is a rectangular hyperbola shaped.

2. Average Variable Cost (AFC):

Q | TVC | AVC | |

0 | 0 | - | Decreases (Stage I) |

1 | 20 | 20 | |

2 | 30 | 15 | |

3 | 45 | 15 | Increases (Stage II &III) |

4 | 80 | 20 | |

5 | 145 | 29 | |

AVC is defined as the TVC divided by the total quantity of output (Q) produced. i.e. AVC = TVC/Q

AVC is U-shaped due to operation of law of variable proportion in the production system in short-run.

3. Average Total Cost/Average Cost (ATC/AC):

Q | TC | ATC(AC) |

0 | 30 | - |

1 | 50 | 50 |

2 | 60 | 30 |

3 | 75 | 25 |

4 | 110 | 27.5 |

5 | 175 | 35 |

Average total cost is summation of average fixed cost and average variable cost. The influence of AVC is more than AFC that is why ATC curve is also U-shaped. The distance between ATC and AVC is AFC.

i.e. ATC = TC/Q = (TFC+TVC)/Q = TFC/Q+TVC/Q = AFC + AVC

C. Short-Run Marginal Cost Curve (SMC)

Q | TC | MC |

0 | 30 | - |

1 | 50 | 20 |

2 | 60 | 10 |

3 | 75 | 15 |

4 | 110 | 35 |

5 | 175 | 65 |

MC is change in TC due to a unit change in output or MC is the additional cost due to increase one unit of output. In other words, MC is the ratio of change in TC to the change in total output.

Symbolically, MC = ΔTC/

(⸪ Q is usually 1)

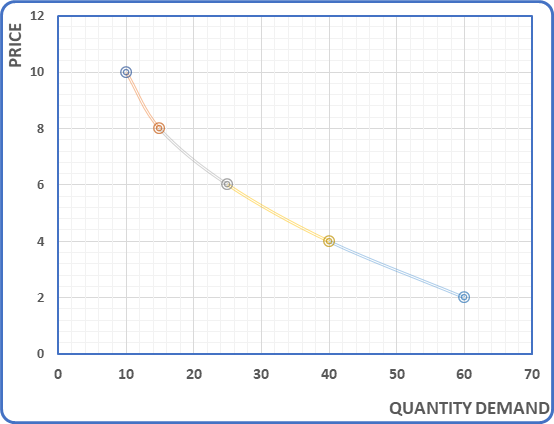

Relationship between AC & MC

Both AC ( =TC/Q) and MC (=)TC/)Q) are derived from TC. So, there is close and important relationship between AC & MC to determine the level of output.

In general both AC & MC are U-shaped and MC = AC when AC is minimum. The relationship between AC and MC can be explained by the help of table and diagram.

Q | TC | ATC(AC) | MC |

0 | 30 | - | - |

1 | 50 | 50 | 20 |

2 | 60 | 30 | 10 |

3 | 75 | 25 | 15 |

4 | 110 | 27.5 | 35 |

5 | 175 | 35 | 65 |

In the table, both MC & AC are derived from the TC. Initially they fall, reach at minimum point and start to rise. MC falls (50%) faster than AC (40%), reach minimum and MC rises (50%) faster than AC(10%).

In the figure, before the minimum point of AC curve, the MC curve falls faster than AC curve and MC curve lies below the AC curve. After the minimum point of AC curve, MC curve rises faster than AC curve and MC curve lies above the AC curve.

- When MC<AC, then AC must be falling

- When MC = AC, then AC are at their minima

- When MC>AC, then AC must be rising

The relationship between AC & MC can be summarized as below:

- Both AC & MC are calculated from TC.

- Both AC and MC are U-shaped.

- When AC is falling, AC>MC because MC falls faster than AC.

- When AC is rising, AC<MC because MC rises faster than AC.

- When AC is minimum, AC = MC

- MC intersects at the minimum point of AC.

Reason for U-shaped Short-Run AC Curve

Short run average cost (SAC) curve is U-shaped. It means that in the beginning, it falls and after reaching the minimum point, it starts to rise upward. It gets U-shaped due to the following reasons.

1. Basis of AFC and AVC:

In the short run, SAC includes AFC & AVC. Therefore, the behavior of SAC depends upon the behavior of AFC and AVC curves.

f variable proportion:

According to this law, when some variable factors are increased, keeping other factors constant, average product (AP) rises in the first stage. Therefore, rising AP in the first stage causes SAC per unit of output fall in the first stage. In the second stage of the law of variable proportions, AP falls. This causes the SAC to slope upward. It is thus clear that the U-shape of SAC is explained by the operation of the law of variable in the short-run.

3. Indivisibility of the factors:

There are some factors which are fixed indivisible in the short-run such as machinery and entrepreneur. In the short run these factors are not fully and efficiently utilized. If the production level increases, these factors are efficiently utilized which helps to reduce the AC. In the beginning the AC falls as the production increases but after optimum level, the AC begins to increase.

4. Economies of Scale:

The internal economies of scale help the AC of a firm to falls, as output increase. The firm enjoys four types of economies namely:

- Labor economies: As output increases, the scope for division of labor extends results labor economies. The division o labor increase efficiency of labor which helps to reduce AC.

- Managerial economies: As the output increases, the total cost of management of the firm is divided into larger output. As a result, the cost per unit of management decline. This helps to decline AC. For example, the salary of the GM of the firm will not double if the output is doubled.

- Technical economies: The use of advanced techniques of production with new plant and machinery leads the technical economies. The use of large machinery and plant helps to reduce per unit of cost of production.

- Marketing economies: The marketing expenditure does not increase directly with the sale of the product of the firm. The cost of advertisement will not double if the output of the firm is doubled. It will probably remain unchanged if the output is increased two times. This makes the per unit advertisement cost decline.

Thus, AC of the firm is decline in the initial ranges of output on account of these economies. The AC of the firm, continuously decline up to the optimum point level. But once the firm exceeds the optimum output, the management becomes un-widely. There is lack of proper supervision. There will be too much overcrowding in the factory, with the resultant deterioration in the efficiency of work. So, the SRAC starts rising.

In this way, the SRAC curve first falls, reaches the minimum point and rises thereafter. Thus, AC curve is U-shaped.

Comments

Post a Comment

If you have any doubt, Please let me know !