Unit 3.3 - Money, Inflation and Deflation

Introduction

In the old days, human life was not as complex as it is today. People were self-dependent because there were a few basic needs to satisfy such as food, clothes, and shelter. With the passage of time and modernization, human wants multiplied. As a result, self-sufficiency came to an end and the process of exchange started, under which people exchanged their commodities for other required commodities. This system is called barter system and the economy is called barter economy. After a long time, because of various difficulties of barter system, money emerged as a medium to make exchange easy or avoid the difficulties of barter system.

Barter System

The direct exchange of one commodity or service for another without the use of money is termed as "barter" in economics. Barter system is that in which no money exists. It is still available in backward remote villages. Direct exchange of goods without the use of money, was not without defects.

Difficulties of Barter System

1. Double Coincidence of Wants

Double coincidence of wants is a pre-condition for the barter system of exchange. The direct exchange of one commodity for another requires direct satisfaction of both the parties (buyer and seller). So, the main disadvantage of this system is the lack of double coincidence of wants. For example, one cow should find the man who wants to exchange rice with the cow. So, arranging for such an exchange would be very difficult.

2. Absence of Standard Value

All the goods which are been exchanged are not of the same value, so it is very difficult to determine the ratio of exchange between the different goods. Even if two persons meet together who wanted each other goods, they could not find a satisfactory equilibrium price.

3. Indivisibility of Commodities

In case of goods which are indivisible the value will be suffered. For example, if the owner of a goat wants to purchase a hen then it will be not possible for him to give a small part of goat to the owner of a hen. In this, he will suffer a loss. It was difficult to divide a commodity without loss in its value e.g., a man wants to purchase cloth equal to half the value of his goat and other commodities for the rest half value of goat; he could not divide his goat.

4. Absence of Store of Value

It is very different to store goods particularly perishable goods for a long period. They lose their value as time passes. Wealth cannot be easily stored for future use in the form of commodities because they perish in the long run.

5. Lack of Deferred Payment

Under this system, it is very inconvenient to lend goods to other people. With the lapse of time the value of goods may fall. So, one would like to suffer a loss. When goods and services are exchanged in credit, they should be repaid in future after some time which is called deferred payment. In the barter system, such type of payment is impossible due to the common measure of rate of exchange.

6. Lack of Transfer of Value

Under this system, transfer of wealth (building, land, machinery) also becomes a problem for the people. For example, one person wants to take one thousand cows from Kathmandu to Pokhara, how much difficulty he would feel?

7. Lack of Specialization

Under the barter system a high degree of specialization is not possible. A person cannot yet the skill of specialization the particular field as we find in the present system of production. Barter system does not make for specialization in production system since every person will want to produce all kind of goods in some quality to be able to carry out transaction.

8. Limited Market

It is not possible to transport goods far and wide. Goods can be transported only in limited areas. International trade requires transportation from one country to another. It is not possible to exchange goods directly for goods in international trade. Even in the international trade, distant areas cannot be covered. Therefore, market remains limited to local areas.

Video Link: Barter System and Its Difficulties

Origin of Money

As barter system was an inconvenient method of exchange, the people were compelled to select some commodities which were most commonly accepted in that area as a medium of exchange. Thus, a large variety of goods came to be used as money. Among them, the major goods used as money were wheat, corn, tobacco, skins, beads, etc. Even live animals served as a medium of exchange at different times and different parts of the world. Later, the metals and metallic coins started to be used as money. After the use of metallic money, gradual development on money began. Later, the metallic coins were replaced by paper notes for reason of economy, convenience and portability. Nowadays, world is practicing for digital money as well.

Meaning of Money

Money is any thing that is generally acceptable as a means of payment in the settlement of all the transactions including debt. It is commonly used as a medium of exchange and means of transferring purchasing power. Money is a social convention. 'We accept money as payment because we expect others to accept it from others'.

Definition of Money

According to Walker, "Money

is that money does".

Similarly, according to

Robertson, "anything which is widely accepted in payment for goods, or in

discharge of other kinds of obligations".

According to Crowther, "Anything

that is generally accepted as a means of exchange and at the same acts as a

measurement and the store of the value is called money."

Importance of Money

Money plays a very important role in the smooth and efficient functioning of the economic system. Without money economic activities like consumption, production, investment, exchange, etc. cannot be performed. It is also regarded as the life blood of an economy.

1. To the Consumer (Importance in Consumption)

The significance of money to the consumer is that the consumer receives income in form of money rather than in form of goods and services. Also, consumer can buy anything with the money s/he has and at any time convenient to him/her. Money enables the consumers to spend their limited income on different goods and services to maximizes their satisfaction.

2. To the Producer (Importance in Production)

All record keeping of all productive activities are kept in money units. These are the account of several inputs, outputs, raw materials, purchases, wages paid to workers, capital borrowed, rent paid and all other expenses incurred in the process of production. In this way, the profits are also expressed in money value. Also, the general flow of goods and services from sectors of the economy are again recorded in money terms. Thus, money is a major contributor in facilitating the growth of industries since all activities are carried out and recorded in money values.

3. Importance in Exchange

In the modern world, large scale production is possible due to the expansion of internal and external trade. Both internal and external trading processes have become easy due to the help of money. Money can be given in the purchase of goods and services and received against the sale of goods and services. So, money is very useful in the exchange of goods and services, and trade.

4. Importance in Distribution

Money also plays an important role in the process of distribution of national income among the factors of production in the form of rent, wages, interest, and profit. All these factor incomes are measured in terms of money. It is because money acts as a general medium of exchange and payment in the settlement of debt.

5. Money as the Basis of Credit Creation and Economic Growth

Since the entire modern business is based on credit which in turn is centered on money, its creation and operations are based and made easy by money. This is achieved through the use of credit instruments issued by banks to their depositors who in turn issue such instruments to investors. In this way, the circular flow of income within the economy is maintained as well as increase in capital formation to investors in particular and economic growth in general.

6. Importance in Measurement of NI

All economic growth indicators such as national income, per capita income and economic welfare are recorded, measured and calculation in terms of money. This is achieved through the changes in the value of money or prices. A fall in the value of money or rise in price means non-progressing economy and vice-versa, which means money serving as an index of economic growth.

7. The Role of Money to Government (Importance in Public Finance)

The introduction and use of money facilitate the collection and recording of incomes and expenditures of the government. Government incomes include taxes of all forms, fines, fees and prices of services rendered. Similarly, the government makes payment of wages, salaries, interest, etc. in the form of money. Also, through the use of various instruments, modern governments achieve the goals of economic policy of improving the welfare and standard of living of the people among others.

8. Importance in Capital Formation

Capital formation refers to the addition in capital stock in a country such as equipment, tools, factories, transportation assets, road, and other physical infrastructures. The process of capital formation is almost impossible without money. Money facilitates institutions mobilize savings from general public and channelize them to the productive uses by providing loans to the investors.

9. Importance in the Price Mechanism

Price mechanism refers to the system where the forces of demand and supply determine the price of goods and services. In the modern age, all the free market economic systems resolve around the price mechanism. Price mechanism operates in the market system through money because all the incomes and prices are measured in terms of money and all the economic decisions are implemented in terms of money.

10. To the Society

Money is at the center of social prestige and power in the society. Money acts as a lubricant for the social life of the people, and oils the wheels of progress of the people. In this way, money, on whose basis the super structure of credit is built, simplifies consumption, production, exchange, and distribution in the society. The foregoing roles of money in the macro economy reveal that money is the pivot around which the whole science of economics clusters and revolves.

Video Link: Origin, Meaning, Definition and Importance of Money

Functions of Money

The importance of money in an economy lies in the functions it performs. These functions not only remove the difficulties of barter system of exchange but also improve the wheels of trade and industry in the economy. These have been classified as primary, secondary and contingent functions of money.

1. Primary (Main) Functions

The primary function are the main functions of money. They are as follows:

(i) Medium of Exchange

The medium of exchange function is the most important and oldest function of money. Money has the quality of great acceptability. As such, all the forms of exchange take place in terms of money.

(ii) Measure of Value

In other words, the price of all the goods and services is expressed in terms of money. The rate of exchange is also determined with it. Measuring the value of goods and services in terms of money has made transaction simple and easy. Money value of goods and services increases or decreases with the decrease or increase in money supply.

2. Secondary (Subsidiary) Function

The secondary or subsidiary functions of money are as follows:

(i) Store of Value

Since savings are now done in terms of money, they are more permanent than they used to be under the barter system. People can hold their wealth in the form of money. Individuals try to save part of their income for their future needs. This is called the store of value.

(ii) Transfer of Value

Money serves as the transfer of value. With the help of money, one can transfer value of his wealth or property from one place to another. A person can sell his/her immovable property at any particular place for money and buy similar property at some other place by using that money.

(iii) Standard of deferred Payment

Money serves as the standard of deferred payment. It refers to those payments which are made sometimes in future. Payment of a loan also refers to the differed payment. Both lending and borrowing are done in terms of money. It is a suitable means of standard of deferred payment because it possesses the quality of general acceptability and it is more durable compared to other commodities.

3. Contingent Functions

The functions of money increase with the economic progress of the country. In addition to the above function, money has to perform certain other functions in the modern economies. These are known as contingent functions of money. The contingent functions of money are as follows:

(i) Basis of Credit

Credit instruments are issued on the basis of money. Money has to be deposited in the banks to issue cheques and drafts. Credit instruments have become widespread. If there had not been the use of money, the use of credit instruments would not have been possible.

(ii) Distribution of National Income

During the barter system, the task of distribution of NI was very complex. But the invention of money has now facilitated factor payments and distribution of NI. Land, labor, capital, and organization participate to produce national income It is distributed to the factors of production in the form of rent, wages, interest, and profit.

(iii) Liquidity and Uniformity of Wealth

Money is generally a liquid form of wealth. It is not possible to use property and assets as desired by their owners. Assets and property become liquid in the form of money. Wealth in the form of money can be immediately used by its owners for any purpose as and when desired..

(iv) Maximum Benefit

Money helps consumers and producers to maximize their benefit. A consumer maximizes his/her satisfaction by equating the price of each commodity with its marginal utility. Consumption in such a manner requires the use of money. Similarly, a producer maximizes his/her profit by equating marginal productivity of a factor to its price. This is not possible without the sue of money.

Video Link: Functions of Money

Forms of Money

Over time, the nature of goods serving as money has changed. The evolution of money depends on a number of factors, such as the relative importance of trade and the state of development of the economy. Various forms of money are:

1. Commodity Money

A variety of localized items like precious stones, skins, bows and arrows, salt, cattle, grains, animal leather, elephant tusks etc. had served as commodity money. But these commodities lacked the qualities of good money such as uniformity, stability, divisibility, durability, transportability and portability. Hence, they were discarded as money.

2. Metallic Money

Metallic money refers to coins made out of various metals like gold, silver, bronze, nickel, etc. This money possessed the quality of good money, so this was used for a long time. The system of using both silver and gold money at the same time is called bimetallism. On the other hand, the use of only one metal as money is called monometallism. A coin is a piece of metal of a given size, shape, weight and fitness whose value is certified by the state. The right of minting coins is the monopoly of the state. Coins are of two types:

(i) Standard or Full-bodied Coins

A coin is regarded as a standard coin or full-bodied coin if its "face value" (i.e., the exchange value fixed by the issuing authority and embossed on it) is equal to its "intrinsic value", i.e., the worth of the metallic content of the coin. The gold and silver coins with definite weight and purity are called standard or full-bodied coins. Its value does not fall even if it is melted or divided into several pieces.

(ii) Token Coins

The token money is made of inferior metals like nickel, aluminum, copper, bronze etc. The face value of token money is higher than the intrinsic value. Its real value disappears when it is melted. They are generally of lower denominations and works as the subsidiary of other money in circulation in the country. Hence, it is also called subsidiary money. Since all types of coins are issued by the state authorities either the Treasury or the Central Bank of the country they are regarded as legal tender. Legal tender money's acceptability is sanctioned of backed up by law; hence, a refusal to accept it is a punishable offence.

3. Paper Money

The money made up of paper is called paper money. It is issued by the government or central bank. Such money possesses higher face value than the intrinsic value. At the present age, paper money or paper notes are widely used in almost every country in the world. Therefore, present age is also called the age of paper money. The use of paper money was first started in China. In Nepal, notes are issued by the Minister of Finance of the Government of Nepal. The paper money is an unlimited legal tender. Hence, all are bound by law to accept any quantity of paper of money. It can be divided into four types. They are as follows:

(i) Representative Paper Money

The paper money which is "fully backed" up by gold and sliver reserves is called representative paper money. This system inspires full public confidence in paper money.

(ii) Convertible Paper Money

The paper money which is convertible into standard coins at the option of the holder is called convertible paper money. The paper notes issued by the monetary authority are also backed by gold and silver reserves, but the value of these "metallic reserves is less than the value of the notes issued".

(iii) Inconvertible Paper Money

The paper money which is not convertible into gold and silver is called inconvertible paper money. Under this system, the note issued is backed by some reserve in the form of gold, silver, government securities, bond, treasury bills, etc. The paper money issued by the central bank is inconvertible paper money.

(iv) Fiat Paper Money

Fiat paper money is also a type of inconvertible paper money. This type of money is issued generally at a time of crisis. That is why, it is also referred to as emergency currency. No reserve of any type is kept behind the fiat paper money. Since, it is issued by the state, it is an unlimited legal tender. Paper money is economical, convenient to carry, easier to count, adjustable supply as per need. However, paper money has also some disadvantages such as excessive money supply, lacks general acceptability, non-durability etc.

4. Bank or Credit or Deposit Money

Bank or credit money emerged due to the development of banking institutions and their credit creation activities. In present day world, the other medium of exchange such as bank draft, traveler's cheque, bill of exchange, promissory note, credit card, debit card, etc. are also counted as bank money. It is not a legal tender. So, bank money is also known as the optional money.

5. Near Money

These are assets that can be easily converted to cash. Their ownership is now transferable simply by book entry. Near or Quasi money includes bills of exchange, treasury bills, shares, bonds, debentures, saving certificates, postal orders, money orders, insurance policies etc. They all have a market value and are negotiable so that they can be converted into real money within a short time.

6. Electronic Money

Electronic money is the name given to several different ways in which the public and financial and non-financial firms use electronic transfers as part of the payments system. Information processing reduces costs of transfer, record keeping, and acquiring information.

7. Digital or E-cash or Internet Money

Digital Currency is a balance or a record stored in a distributed database on the internet. For example, cryptocurrencies, bitcoin, virtual currencies, central bank digital currencies and e-cash. It exhibits similar properties to other currencies. Not having a physical form, they allow for nearly instantaneous transactions. Usually not issued by a governmental body.

Video Link: Forms or Types of Money

Qualities/Features/Characteristics of Good Money

The characteristics of money money are general acceptance, portability, storability, divisibility, uniformity, limited supply, durability, economy, uniformity and stability can be described as follows:

1. General Acceptance

The essential quality of goods money is that it should be acceptable to all, without any hesitation in the exchange of money for goods and services.

2. Portability

It is also an important quality of good money. Money should be easily transferable (large value in small bulk) from one place to another for doing business and making payment. The paper money is easier to carry because it has minimum possible weight than the metallic money.

3. Storability

Money should be storable and it should not depreciate with time. If the money used is perishable, it will lose its value in a few days. Paper money has this quality of storability.

4. Divisibility

Good money is that which could be divided into small units without losing any value. The smaller the divisions, the better.

5. Durability

Money should be durable. It should not lose its value with the passage of time. This characteristic means that an item retains the same shape, form, and substance over an extended period of time; that it does not easily decompose, deteriorate, degrade.

6. Economy

It is also an important quality of good money. Money should be made economically. If there is a heavy cost on issuing more money, then that is not good money. Good money is that which has low cost and more supply. Paper money has this quality of economy.

7. Uniformity

Money should be homogeneous. Its units should be identical. For example, all one-rupee notes should be identical in shape, size, color, weight, and content. Uniformity helps to recognize the money easily.

8. Stability

For money to serve as a measure of value and be used as a means of deferred payment, it should be stable in value over time.

9. Limited Supply

In order for money to retain its worth, there must be a type of limited supply. The more money that is in circulation the less it is valued by the economy.

Video Link: Characteristics or Features or Qualities of Good Money

Value of Money

Value of money means purchasing

power of money over goods and services in a country, or what money can buy in

terms of goods and services. The indicator of the value of money is the price

level within an economy. Thus, the term "Value of money" is a relative

concept which expresses the relationship between a unit of money and the goods

and services which it can purchase.

The relationship between the

value of money (V) and the price level (P) is an inverse one. Thus, when the

price level rises, the value of money falls because the same unit of money can

purchase less than before. Conversely, when the price level falls, the value of

money rises because the same unit of money can buy more quantities of goods and

services than before.

There is a negative relationship between the value of money and the price level. But there is a direct relationship between the value of money and it purchasing power. The higher the value of money, the higher will be its purchasing power and the lower the value of money, the lower will be its purchasing power.

Considering that money is adopted for both internal and external transactions there exists, therefore, two types of value of money viz:

- Internal value of money referring to the purchasing power over domestic goods and services,

- External value of money referring to the purchasing power of money over foreign goods and services.

According to Irving Fisher,

" The purchasing power of money is the reciprocal of the level of

prices."

According to Robertson, "The

value of money means the amount of the things will be given in exchange for a

unit of money."

Thus, the value of money is its

purchasing power and there is an inverse relationship between the value of

money and price level.

The value of money can be

expressed symbolically as follows:

Vm = 1/P

Where,

Vm = value of money

P = Price level

Video Link: Value of Money

Quantity Theory of Money (Fisher's Equation)

The QTM is a extremely old theory (proposition) of Economics.

It was first propounded by Italian Economist, Davanzatti. Later, the classical

economists explained the value of money in terms of quantity of money. The

classical economists like David Ricardo, David Hume and J. S. Mill improved and

refined the body of this theory. Finally, the credit for popularizing this

theory goes to the well-known American Economist Irving Fisher (Yale

university). He explained this theory in this book "The Purchasing Power

of Money" published in 1911.

According to Fisher, "Other things being equal, as quantity

of money in the circulation increases, the price level also increases in direct

proportion and the value of money decreases and vice-versa." It means that

if the quantity of money doubles, the price level will also be doubled and

vice-versa.

Assumptions

- There is a state of full-employment in the long-run.

- Money is an only medium of exchange and there is no existence of barter system.

- Money is not used for accumulation, i.e., all money is used for the exchange.

- The money stock (M) was taken to be exogenously determined by the monetary authority and independent of the other 3 variables V, T and P.

- The velocity of circulation (V) was assumed to be more or less constant and was determined by conditions in the financial system that tends to change very slowly. Again, V was thought to be independent of M, P and T.

- The volume of trade per period (T) was also taken as fixed. Recall that Classical scholars believed that in the long term, output tended to be at or near the full employment level.

- The price-level (P) is a passive variable. It is determined and controlled by the other variables of the equation.

Fisher's Transaction Approach (Fisher's Equation)

Fisher's analysis commences with a simple identity (a

statement that is by definition true), sometimes referred to as the equation of

exchange.

MV = PT ………………..(i)

Or,

Or, PµM, since V, T constant

Where,

- M = Money Supply (Total amount of money in circulation)

- V = Transaction velocity of circulation of money (the number of times the money stock changes hands per period)

- P = Price level

- T = Total volume of trade or transaction of goods and services (the number of transactions undertaken per period)

MV (buyer side) = PT (seller side)

Nominal GDP = P × Real GDP

Nominal GDP = Nominal GDP -------------- Identity Equation

Note that,

MV = Money stock × number of times the money stock is spent

per period = total spending per period

PT = Price of goods and services × Volume of goods &

services bought per period = total spending per period

Above equation implies that the quantity of money determines

the price-level; the price level, in its turn, varies directly with the

quantity of money (provided V and T remain constant). In the above equation of

exchange only primary money or currency money has been included.

Fisher's equation can be illustrated by the help of an

example,

Suppose quantity of money, M = Rs. 10,000

Velocity of circulation, V = 10

Total transaction, T = 5,000

Hence,

Now, suppose that the quantity of money has increased to Rs.

20,000. There is no change in velocity of circulation and total transaction.

Hence,

This explains that when the quantity of money doubles, the price

level will also be doubled and vice-versa. From the above example, it can be

concluded that any given percentage change in the quantity of money will have

the same percentage change in the price level, other things remaining the same.

The equation of exchange shows that the price level and therefore the value of money are influenced not only by the quantity of money but also by

- The rate at which money circulates, and

- The output of goods and services.

Hence, the price might rise with any change in quantity of

money if there is a rise in the velocity of circulation. On the other hand,

price might remain stable in spite of increase in quantity of money if there is

a corresponding increase in the output of goods and services.

In above equation, Fisher had included only cash and coins.

Later, this equation is changed slightly by Irving Fisher, by introducing

credit or bank money in the supply of money. To understand this fully, we must

be more specific about the definition of money. Money can be narrowly conceived

of as notes and coins in circulation. However, bank deposits can also be

properly regarded as a component of the money stock. Classical economists

focused on the ability of banks to create money through the expansion of loans.

Fisher restated his equation of exchange to incorporate the banking sector.

Thus, PT = MV + M'V' ………………(ii)

Where, M = quantity of currency (termed primary money by

Fisher)

V = the velocity of circulation of currency

M' = the quantity of bank deposits

V' = the velocity of circulation of deposit money (constant

relationship with the currency money, M).

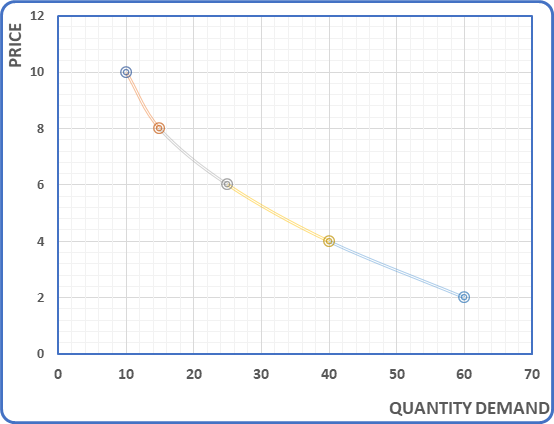

The quantity theory of money can be explained with the help

of following table:

The above table with hypothetical data figure shows the

relationship between money supply, price level and value of money. When money

supply increases from M1 to M2 to M3 to M4

then price level also increases from P1 to P2 to P3

to P4 respectively. On the other hand, when price of the

commodities increases from P1 to P2 to P3 to

P4 then value of money declines from V1 to V2

to V3 to V4 respectively. Where value of money is

inversely proportional to price level.

The above figure with hypothetical data figure shows the relationship between money supply, price level and value of money. In the above diagram Figure (A), upward sloping line P = f(M) shows the positive relationship between money supply and price level. Similarly, in the below diagram Figure (B), downward sloping line V = f(M) shows the negative relationship between money supply and value of money.

Criticisms

The equation MV = PT is a simple truism. It says nothing about what determines what. Fisher's quantity theory of money has been criticized on the following grounds:

(i) Based on the Unrealistic Assumptions

This theory is based on the unrealistic assumptions of long period and full employment. It neglects the short-period problems but the actual problems are short-run problems. Full employment is not possible in the real world. It is just an imaginary concept. According to Keynes, "In the long-run, we all are dead."

(ii) Static Theory

This theory assumes that V, V' and T remain constant. But, in reality, these variables do not remain constant even in the short-run. They change with change in economic activities. During the boom stage, they increase and during the depression stage, they decrease.

(iii) Ignores other Determinants of the Price-level

This theory maintains that the price-level is determined only by the factors M, V, and T. It ignores other factors like income, investment, expenditure, saving, population etc. which also play an important role in the determination of the price-level.

(iv) Money is not only Medium of Exchange

This theory assumes money only as a medium of exchange and completely ignores other important functions like store of value, measure of value, standard of deferred payment, etc.

(v) Not Independent Variables

This theory assumes that all the four variables M, V, P and T are independent. But in reality, all these four variables are not dependent with each other. The change in one variable affects the other variable. For example, a change in M is likely to bring about change in V and T. Similarly, a change in P causes to change in M because the higher price level may necessitate the issue of more money to carry on transactions.

Concept of Inflation and Deflation

Concept of Inflation

Inflation is defined as a persistent rise in the general price level. During inflation, the purchasing power of money or the value of money falls because there is an inverse relationship between the general price level and the value of money. It is usually measured as a percent per unit time, say, a year. Thus, while talking about inflation, we speak of prices rising at the average rate at 10% or 15% or 20% per year. It is regarded as a major economic problem. The rate of inflation is higher in the developing countries compared to the developed countries.

There are various definitions of inflation given by the economists. Among them, important definitions are as follows:

Thus, we can conclude that inflation is the rise in the overall level of prices or fall in the value of money in the economy.

Features of Inflation

Types of Inflation

There are many types of inflation. Among them, the major types of inflation are as follows:

Causes of Inflation

Various economic theories (school of economic thought) have explained the causes of inflation in different ways.

According to classical theory of QTM (MV =PT) states that inflation in the economy (P) is always proportional to the money supply (M) assuming volume of real output (or volume of real transaction, T) being fixed at the full-employment and velocity of money (V) also remaining constant. Thus, according to the classical QTM inflation (change in the general price level) is directly dependent upon the quantity of money supplied in the economy.

In Keynesian theory, if planned aggregate expenditure exceeds the total available output at full employment (i.e., C+I>Y, or C+I+G>Y, or C+I+G+X-M>Y), it causes inflation. For Keynes, inflation is generally a non-monetary phenomenon. Keynes defined inflation as a phenomenon of full employment. According to him, inflation is the result of the excess of AD over the available AS & true inflation starts only after full employment. If economy is not at full employment level, increase in money supply leads to increase in both output & price.

According to Milton Friedman, a leading monetary economist, "inflation is always and everywhere is a monetary phenomenon". This theory also shows the relationship between P & M but not proportional as explained in the classical theory. Many economists like Friedman & Phelps says that inflation expectation (adaptive and rational) also plays an important role in inflation.

Incorporating both Classical and Keynesian views, the modern theory of inflation takes into account both monetary and real factors for explaining the causes of inflation through demand-pull and cost-push arguments.

Demand-Pull Inflation

Inflation due to excess demand (AD>AS) is called demand-pull inflation. This increase in demand 'pulls' prices upwards if the economy does not have spare capacity to meet increase demand.

The effective demand (AD) increases due to increased money incomes of the owners and suppliers of factors of production due to increase in investment (I) in the economy. Household consumption demand (C) also increases over time and the works for government's demand for goods and services.

As a result of the increase in aggregate demand comprising of C, I & G for goods and services tends to be high. Here, "too much many chases too few goods" in the economy. It means the purchasing power or the value of money decreases.

a. Short-Run

With the rise in AD, the price level also increases. This is condition of semi-inflation not the pure one because of simultaneous rise in AS quantity until the economy reaches the full employment level.

b. Long-Run (Keynesian)

In the the figure AD1 intersects AS curve at point A where the equilibrium price level is P1 and quantity is Q1. When AD increases, the initial AD1 curve shifts rightward to AD2 and AD3 which intersects the initial AS curve at points B and C in which the new equilibrium price level are P2 and P3 respectively. The price increase from P1 to P2 and P3 is called semi-inflation. The price increase from P1 to P2 and P3 is due to increase in AD for goods and services at a given supply situation. Corresponding to the P3 level of price, the economy has reached at full employment level. So, the AS curve becomes vertical.

If there is further increase in AD3 to AD4 it increases price level to P4 where there is no increase in output. Such increase in price level is called pure inflation.

c. Monetary Theory

MS↑ with Constant V and Constant T (full employment) → Money Exp. ↑→ AD↑→P↑→Inflation.

Causes of Demand-Pull Inflation

1. Increase in Money Supply

When the central bank increase money supply, the rate of interest declines and business investment usually. Increased investment brings more increase in the level of nation's output and income through the investment multiplier effect. Increase in income causes a rise in consumption expenditure which raises the AD. Money supply can be increased through various ways such as excess printing of banknotes by central bank, high credit creation by lowering central bank policy rates such as cash reserve ratio (CRR), refinance rate, bank rates, etc. and buying securities form the banks and public in the open market.

MS↑ (note issue, credit creation, declining CRR, bank rate, buying securities)→ IR↓→I↑→Y↑→AD↑

2. Increase in Government Expenditure

When the government expenditure increases, it raises the income level of the people. An increase in the employees' salary, pensions or any other benefits raises the AD. Similarly, the government's development expenditure provided employment opportunities to the people. This raises the income level and consequently pushes the AD up. At the given supply situation, any increase in AD ultimately results in inflation.

G ↑(Regular: salary, pension & Development: employment) → Y↑→ AD↑

3. Increase in Private Expenditure

Total private expenditure has two components: consumption and investment expenditure. Increase in consumption expenditure directly raises AD. Likewise, increase in investment leads to more employment opportunities and hence higher income level raises AD. Consequently, the prices level increases.

C↑ →AD & I↑→ Employment↑→AD↑

4. Reduction in Taxation

Reduction in the direct tax rate and tax net causes higher disposable income of the people which raises the AD. At a given supply situation, a higher demand results into inflation.

Tax↓ (Direct) →DI↑→AD↑

5. Increase in Export and Decrease in Import

Increase in export means increase in inflow of foreign currency. It causes increase in income level of citizen which ultimately raises AD. At a given internal supply situation, a higher demand situation results into inflation. On the other hand, a higher export and reduction in imports of goods and services may cause shortage at home country. This puts pressure on demand thereby causing inflation.

X↑→Forex↑→Y↑→AD↑ and X↑&M↓→Shortage of commodity →Pressure on AD

6. Deficit Financing

When the government budget is insufficient to meet its expenditure, it is called deficit budget. Such deficit is generally financed through internal and/or external borrowing and foreign grants. A higher amount of deficit financing is required when the government increases expenditure in relation to its revenue. As mentioned above, a higher expenditure raises the AD and hence the price level. In the worst case, when the government finances its deficit by printing excess money, it causes inflation which may be ever more difficult to control. Such situation arises especially during the war or internal conflicts.

Payment of debt →Y↑→AD↑

7. Increase in Population

If the population size increases aggregate demand for goods and services also increases. At a given supply situation, it puts the pressure on demand results into inflation.

Pop↑→AD↑

8. Increase in Forex

Increase in foreign currency inflow through remittances, foreign loan, grants etc., raises the income of the citizen and it leads to pressure on demand thereby causing inflation.

Forex↑→Y↑→AD↑

9. Increase in Bank Credit Creation

10. Increase in Velocity of Money

When speed of movement from the hands of one person to another increases demand for goods and services also increases.

V↑→Money circulation↑→AD↑→Inflation

11. Depreciation of Domestic Currency

Depreciation of domestic currency makes export cheaper. So, export increases and there may be shortage of goods in goods in domestic country due to mass import which ultimately raise AD and bring inflation.

Dep. of NRS. → Export Cheaper → X↑→Shortage of commodity↑→AD↑→Inflation

12. Rapid Economic Development of Trading Partner

Due to economic prosperity of trading partner (India) their Per Capita Income (PCI) increases and they import more (from Nepal). This creates shortages of goods in domestic country (Nepal). This ultimately raise AD and bring inflation.

Econ. Devt. →PCI (India)↑→X from Nepal↑→shortage in Nepal→AD in Nepal↑→ Inflation

Cost-Push Inflation

This type of inflation is opposed to monetary inflation because it is caused by an increase in production costs. The costs of production increase mainly due to:

The trade union or monopoly supplier of labor may give pressure to increase the existing wage rate. Such increase in wages and other factor costs increase prices in the economy. On the other hand, the producers may increase profit margin which causes prices to push up. Cost-push inflation is also known as supply side inflation. It is caused by decrease in supply of goods and services or increase in cost of production.

Some non-economic factors such as weak law and order situation, political anarchism are at play, the general price level increases. Such increase in price is termed as cost-push or supply side inflation as shown in the figure below.

In the figure, price level and quantity are depicted on vertical and horizontal axes respectively. In the beginning, AD and AS1 curves intersect each other at point A where the equilibrium price level is P1 and quantity is Q1. Due to the factors mentioned above, supply of commodities decreases and the initial

AS curves shifts leftward from AS1 to AS2, new equilibrium is restored at point B with higher price level P2. If AS further declines, the AS curve shifts to AS3 thereby given rise to a further increase in equilibrium price. Thus, such increase in price level from P1 to P2 and further P3 is called cost-push inflation. From the above figure, it is obvious that a decrease in AS of goods and services in relation to AD gives rise to inflation.

Causes of Cost-Push Inflation [First price and then AS]

Due to increase in factor and non-factor cost (R, w, r, B), price of the product increases directly but the production/output (AS) indirectly ultimately leads to inflation known as cost-push inflation.

1. Wage-Push or Increase in Wage Rate

Without increase in productivity of labor if the wage rate of labor increases due to the active presence of powerful trade unions or monopoly supplier of labor, producer reimburses the increased wages by increase in commodity's price giving rise to inflation. It is to be noted that every increase in wage may not be inflationary if it is proportional to an increase in the labor productivity.

2. Increase in Input Prices and Interest Rates

The production costs of final goods and services also increase due to higher prices of non-factor inputs such as petroleum products, electricity, water supply, raw materials, etc. Likewise, an increase in rate of interest raises the cost of capital. These factors ultimately give rise to inflation.

3. Profit-Push or Increase in Profit Margin

Profit-push inflation is the outcome of imperfect market like monopoly or oligopolistic situation. So, due to market imperfection, producer practices syndicate and cartel power (price fixing, limiting supply, control selling prices or other restrictive practices) to earn more profit and firms in such situation are assumed to apply a markup factor to their labor and material cost per unit of output. In such market, markups or profit margins are pushed up, without any increase in cost or demand. The resulting increase in price is called profit-push inflation.

4. Indirect Taxation or the Removal of Subsidies

Increase in indirect tax like VAT, excise duty, custom duty etc. directly raises the prices of goods and services. Likewise, removal of government subsidies also leads to the consumer to pay full or high prices of subsidized goods.

5. Devaluation or Depreciation of Currency

If the domestic currency is devaluated against foreign currency, the prices of imported goods (petrol, raw material, final goods) increases. If the economy is predominated by imports, it will have greater impact on the domestic price movement thereby leading to a higher inflation.

6. Imported Inflation

Inflation in trading partner economy shifted to other country whose economy is predominated by imports. For e.g. inflation in India can be shifted in Nepal because of more than 60% import of Nepal from India.

7. External Shocks

Due to foreign war, political change, worldwide recession creates adverse shocks in this global economy because it increases the prices of gold, energy, dollar results inflation in many countries.

8. Overexploitation of Natural Resources

Natural resources are in limited resources. If we exploit it in great extent, the cost of production increases which also raises the price of commodities.

Supply Side Causes of Inflation [First AS and then Price]

Due to decline in production/output (AS) directly and increase in price of the product indirectly ultimately leads to inflation known as supply side causes of inflation.

9. Natural Disaster

Flood, landslide, drought, heavy rainfall, and climate change may causes to reduction in output (AS) which increases the price and inflation ultimately.

10. Labor-Management Relations

Dispute conflict, strike may affect production (AS) inversely.

11. Lack of New Technology

In LDCs, there is lack of ability to spend on R&D and use of technology is very low. Hence, law of diminishing return operates (MP↓) in production and AS reduces.

12. New Tax

Introduction of new tax on industrial output discourages production and ultimately AS reduces that results in inflation

13. Supply Shocks

Many factors such as crop failures, natural calamities, uncertainty in power supply (load shedding/power shortage) and petroleum products; lack of peace & security (strikes, insecurity, political anarchism); administrative hurdles; inconvenient & volatile government policy etc. create obstacle in smooth production & supply (AS) of commodities also which results increase in price thereby leading to an inflationary situation.

Effects/Consequences/Costs of Inflation

A mild degree (2 to 3%) of inflation has a positive effect on the healthy functioning of the economy as a tonic. Increasing prices raises the profit margin that stimulates producers to undertake more investment. As a result, production and employment increase particularly when there are unemployed resources in the economy. Inflation may be desirable so long as it is well under control and increases output and employment. The rate of desirable inflation depends upon the need and absorption capacity of an economy which is subject to variation from time to time. According to Samuelson, mild inflation lubricates the wheels of trade and industry.

However, economists generally believe that galloping and hyperinflation have quite a few serious and harmful consequences for the economy. These harmful effects of inflation are discussed below:

Economic Effects

1. Effects on Production

a. Reduction in production: A Demand-pull before full employment situation impulse would shift the demand curve up, resulting rise in price level as well as output and employment. Whereas, cost-push leads to a rise in price level but a drop in output and employment. Sharp rise in prices creates uncertainty in the economy. It has adverse effect on investment and production activity. As a result, production decreases.

b. Change in pattern of production: During inflation profits rise sharply and producer diverted their resources to produce luxurious (high priced goods) from low priced essential commodities.

c. Encourages speculation: The entrepreneurs' speculative activities in order to make easy and quick profits suffer the productive activities.

d. Fall in quality of product: Inflation reduces the degree of competition where producer able to sell whatever they produce (sub-standard). Therefore, inefficient producers with technically inefficient plants and equipment are protected.

e. Reduction in saving: When price rises, marginal propensity to save (MPS) declines and it adversely affects investment capital formation. As a result, production is hindered. [P↑→ MPS↓→S↓→I↓→Prodn↓]

f. Hinders foreign capital: Rising cost of materials and other inputs at the time of inflation makes foreign investment less profitable. So, inflation hinders the inflow of foreign capital and does not support the production.

2. Effects on Consumption

Inflation creates adverse effect on consumption because of deterioration of purchasing power where people need more money to buy same products.

3. Effects on the Distribution of Income

Inflation leads to inequitable and arbitrary redistribution of income and wealth in the society where it creates divergence between total price received and paid. An advantage (gain) accruing to flexible income group of people may be at the cost (lose) of the fixed income groups due to changes in asset portfolio and wealth distribution pattern. Effects of inflation on different sections of the society are discussed below:

a. Debtors and Creditors: Debtors benefited during inflation (10%↑ in P) because they had borrowed money (Rs.1000) when the purchasing power of money was high and with interest (10%) they return it (Rs.1100) when its purchasing power (Rs.1100 = Rs. 990) is low due to price rise. Debtors return the loan in terms of their face value but in real terms they pay less. Inflation would have opposite effect on creditors since the loan repaid and interest received would have less real value as a real result of rise in prices.

b. Profit Earners: Entrepreneurs (traders, merchants) tend to earn windfall profits because rise in prices leads to increase in factor prices and cost of production only after some time-interval. Moreover, entrepreneurs earn profits due to increase in the value of the stock of goods and raw materials them possess.

c. Wage-Earners and Salaried Class: Wage-earners and salaried class tend to lose during inflation mainly for two reasons. Firstly, in most cases wage and salary increases generally fail to keep pace with the rising prices (P↑>w↑). Secondly, there is a lag between the price rise and increase in wages and salaries (P↑ continuously but w↑ at a point of time). In fact, wage-earners tend to lose more in those sectors where the workers are not organized in the form of trade unions.

d. Investors: Inflation has a mixed effect to: (a) investors in equities (share) gain since dividends increase as a result of increase in corporate profits and (b) investors in fixed-interest earning assets (bonds, debenture and deposit with commercial banks) tend to lose because they receive a fixed interest income from such investment.

e. Pensioners and Fixed Income Groups: Pensioners (retired) people who survive on pensions are likely to suffer (lose) during inflation for two reasons. Firstly, in many cases pension (money income) is fixed during inflation. Even and where pensions of the retired people (civil servants, army personnel and teachers) are periodically revised, the increase in pensions LDCs does not keep pace with the rising prices (P↑>Pension↑). Secondly, pensioners' savings in the bank and postal deposits gives them a fixed income in the form of interest.

f. Farmers: Farmers as a group stand to gain because the prices of agricultural products outpace the increase in price of farming inputs. Moreover, debtor farmer gain during inflation as far as their debt burden is concerned. However, it is doubtful whether small farmers or substance farmers gain during inflation since they do not market much of their produce.

4. Adverse Effect on Savings

During inflation, small savers (bank deposit, bond & debenture) find the real value of their investment falling by large magnitude during the period of rising prices. This reduces the motivation for savings. So inflation wipes out savings.

5. Effects on the BOP

If rate of inflation in the country is higher than in other countries, exportable commodities would become relatively expensive in the world leading to fall in exports. On the other hand, our importable commodities would become relatively cheaper and this would increase our imports. Thus, decreased exports and increased imports would adversely affect the current account (CAt) of the BOP.

6. Effects on Public Revenue

As prices rise, the revenue earned from indirect taxes (excise duties, sales tax) will also increase. Moreover, revenue from direct taxes (income tax) will rise at a faster rate than the growth of money-incomes due to progressive tax system in most of the countries.

7. Confidence in the Currency

A high rate of inflation can undermine (loss) the confidence of the people in the currency, disrupts price mechanism and creates uncertainty in the economy. Money cannot function as money and people do not like to hold the currency. People start preferring commodities (barter system) over money in their transactions. Monetary system ultimately breaks down. In Germany during the hyper-inflation in 1923 people refused to accept Mark.

Non-Economic Effects

8. Social and Moral Degradation

Periods of hyper-inflation are often associated with social and moral degradation. Inflation led to lower quality goods, hoarding; black marketing; thefts; robberies; and widespread corruption among businessman, government officials and politicians. Income inequality due to inflation crates class struggle and civil war.

9. Political Instability

Continuous inflation in many cases has shaken the foundations of the political system. It has become a major political issue during many elections. History is full of instances when many governments lost power because of persistent rise in prices. For example, Nazi revolution in Germany was the outcome of hyper-inflation of 1923.

Concept of Deflation

Deflation is a term which has two meanings. "Deflation is a situation in which the prices of most goods and services are falling over time" (Andrew B. Abel, Ben S. Bernanke and Dean Croushore). However, it can also use to describe a slowdown (recession) in the rate of growth of output of the economy often associated with a fall in the rate of inflation below 0%.

Thus, only those widespread falls in prices which cause unemployment and fall in the level of incomes of the factors of production in the economy is the deflation. The continuation of falling prices in general create a vicious spiral of negatives such as falling prices, closing factories, declining employment and incomes, and increasing non-payments of loans by firms and individuals, and worse situation of recession and depression.

"The effects of unanticipated deflation (declines in the price level) are the reverse of those of inflation. People with fixed nominal income will find their real income enhanced. Creditors will benefit at the expense of debtors. And savers will discover that the purchasing of their savings has grown because of the falling prices". (Campbell R. McConnel and Stanley L, Brue)

The fall in demand would be because of a reduction in money, credit or consumer spending. If more goods are produced than demanded, business must reduce their prices to get people to buy those goods. Less money in circulation reduces spending and decreases demand for goods in general

[AD↓→P↓→Prodn↓→emp↓→Y↓→AD↓]

History of Deflation in the World

The sustained deflationary episodes of the Great Depression in the 1930s and those in Japan in the second half of the 1990s have some underlying factors in common.

From August 1929 to March 1933 the real GDP in the US fell by almost 30%, or 7.6% on a yearly average. Similar drastic declines in average annual output also occurred in other countries, for example, in Canada (-8.4%), Germany (-2.7%), UK (-1.0%) and France (-2.2%).

Causes of Deflation

- Sudden increase in output: AS>AD→P↓

- Technological development: Tech Adv→ Cost of Prodn↓→Prodn↑→P↓

- Fall in demand: AD<AS

- Decrease in supply of money: Ms↓→AD↓→P↓

- Decreasing nominal prices for goods: Tech. Adv & resource availability →nominal P↓

- Deflation occurs when AS>AD for goods.

- Control of bank credit by central bank: Credit↓→AD↓→P↓

- Increase in rate of taxes: Tax↑→Prodn↓→emp↓→Y↓→AD↓→P↓

Effects of Deflation

Following are the diverse ways in which deflation impacts the economic condition of a country:

1. Improvement of Production Efficiency

Deflation results in the improvement of production efficiency, due to lowering of the overall price of commodities. The consumers are required to make low payment while buying those goods.

2. Escalation in the Purchasing Power

The per-head availability of hard money reduces. This leads to the escalation in the purchasing power of each unit of currency.

3. Negative Impact on a Country's Economic Condition

This is because the advent of deflation acts as a tax on the borrowers and the liquid asset holders simultaneously.

4. Discourages Both Investment and Expenditure

Deflation brings with it, a fall in the AD. In this case, there is fall in the prices, resulting in the creation of a vicious circle. [AD↓→P↓→Prodn↓→emp↓→Y↓→AD↓] Perhaps, the greatest instance of deflationary spiral is the Great depression.

5. Decreasing the Velocity of Money

According to the monetarist theory of deflation, deflation affects an economy by decreasing the velocity of money or the number of commercial transactions more or less permanently. This leads to the emergence of a remarkable contraction in the supply of money.

Control of Deflation

To work against deflation, the central bank can use monetary policy to increase the money supply and deliberately include rising prices, causing inflation. Rising prices of products will work as lubricant to sustained recovery because businesses increase profits and get rid of some of the depressive pressures of wages and debtors. The government can use its fiscal policy to stimulate demand and create jobs.

Comments

Post a Comment

If you have any doubt, Please let me know !